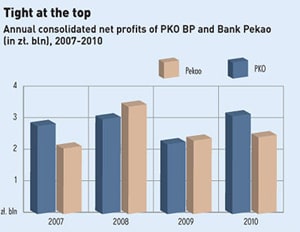

Poland’s largest lender, the state-owned PKO Bank Polski, saw its 2010 net profit rise nearly 40 percent due to higher volumes and lower provisions for bad loans.

The bank booked a profit of zł.3.22 billion for the year, benefiting from Poland’s strong economic growth last year. The lender’s result was slightly above the market’s expectations.

Chief executive Zbigniew Jagiełło told the press that PKO could make a profit of zł.4 billion this year, as long as the economy continues to grow at a healthy pace and costs from bad loans fall.

“The gross profit figure for 2010 [zł.4.08 billion] may be the net profit for 2011,” he said.

PKO’s board intends to recommend a dividend of 40 percent of net profit.

Meanwhile, Bank Pekao, the country’s second-largest bank by assets and one of its more conservative lenders, saw less pronounced growth than many of its rivals in Q4.

It reported a below-forecast five percent rise in net profit for 2010 on weak loan growth. In total, the lender – a unit of Italy’s UniCredit – made zł.2.53 billion.

Deputy chief executive Luigi Lovaglio said, however, that he expects Pekao’s net profit to increase this year on cost control and loan growth.

The bank has proposed a dividend of zł.1.78 billion on its 2010 takings.

On balance, Poland’s banking sector had a strong 2010 as the number of non-performing loans didn’t proliferate to levels feared at the start of the crisis. The country’s banking regulator, the Financial Supervision Authority, has estimated that banks’ combined net earnings in 2010 rose by 41 percent y/y to zł.11.7 billion.

From Warsaw Business Journal by Gareth Price, Natalia Kazik